GDPR vs. U.S. State Privacy Laws

GDPR vs. U.S. State Privacy Laws

These days, privacy is beginning to feel more like a privilege than a right. Once a consumer creates a profile on a new dating app, enters an email address in exchange for that coupon code to a free pint of Jeni’s Splendid Ice Cream, or keeps tabs on how far they’ve walked this month with an Apple Watch, can anyone say with confidence that they know what happens with that data? Is it floating around the ether of the internet? Is it holed up in some dusty corporate database? Is it being shared with shadowy third-party data brokers? Or is it being carefully managed under the good stewardship of a business, one that scrupulously follows privacy best practices while using that information to inform business decisions and improve products and services? The questions about what happens with personal data have been plaguing businesses and consumers alike for decades. One of the goals of privacy professionals is to bring privacy issues into clearer focus for businesses—and an important place to start is understanding the scope of privacy legislation. And if you’re going to have this conversation, you have to take a close look at the General Data Protection Regulation (GDPR) and U.S. state privacy laws. Why should companies be thinking about GDPR and state privacy laws? If your company is the victim of a security breach, it’s not just your company’s information being jeopardized. Also at risk are the names, contact information, credit card numbers, and other personal identifiable data of your clients and customers. And even if you were not at fault for the incident, you may still be held liable—and you may even end up owing damages to any individuals whose information had been compromised. Privacy policies aren’t just about legal compliance, though. Paying attention to privacy is especially important for building consumer trust well before a potential cyber attack. In fact, research shows that 76% of companies that invested in privacy saw an increase in customer trust and loyalty. What is the GDPR?The General Data Protection Regulation, or GDPR, implemented in May 2018, is a European Union law that requires organizations to protect personal data and uphold the privacy rights of anyone in the EU. It’s regarded as the toughest privacy and security law in the world.The GDPR doesn’t just apply to organizations based in the EU, though. Anyone who collects, stores, transmits, or otherwise processes the personal data of anyone in the EU must comply with the GDPR, meaning that it can affect organizations all over the world. And by personal data, we’re talking about any information about an individual: name, contact information, IP address, eye color, relationship status, political party, religious affiliation—you get the gist. Even if the information in question may seem inconsequential, the policies relating to it certainly aren’t. Those who violate the GDPR’s privacy and security standards can be fined up to tens of millions of euros. A brief history of the GDPRPrivacy protection has been a matter of importance since before the age of the internet. As stated in the 1950 European Convention on Human Rights: “Everyone has the right to respect for his private and family life, his home, and his correspondence.” Based on this solid foundation, the EU has continued to protect the right to privacy. In 1995, in light of technological advances and expanded use of the internet, it passed the European Data Protection Directive, which established minimum data privacy and security standards that each member state then implemented as part of its own legal framework. As technology continued to evolve with online banking, social media, and online shopping, the data protection authority declared a need for “a comprehensive approach on personal data protection.” This came shortly after a 2011 lawsuit in which Google was sued for scanning emails. In 2016, the GDPR was passed by the European Parliament. And on May 25, 2018, it was fully in effect, requiring compliance from organizations of all sizes around the world. What’s covered in the GDPR? Essentially, the GDPR sets guidelines for organizations that handle any personal information pertaining to EU residents. At its core, it’s about giving individuals control over their data, whether it involves finances, email addresses, demographic information, or other items. The GDPR establishes several rights for individuals, including:

The right to be informed

The right to access

The right to rectification

The right to erasure/to be forgotten

The right to restrict processing

The right to data portability

The right to object

Rights related to automated decision making and profiling

The right to know how their collected personal information is used and shared

The right to delete their collected personal information

The right to opt-out of the sale of their personal information

The right to non-discrimination when exercising CCPA rights

Earns more than $25 million in revenue per year OR

Collects or processes 100,000 consumer records per year OR

Derives 50% of its annual revenue from selling personal information

Establish a compliant privacy policy and update it annually

Maintain a data inventory to track data processing

Notify consumer before at point of data collection

Establish a Do Not Sell My Personal Information page on your website

Inform consumers how their data is being used and how to make individual rights requirements

Establish reasonable data security protocols

Adhere to contractual obligations for vendors

Maintain limited defense against private action

Follow data minimization practices

Controls or processes the personal data of 100,000 or more Colorado consumers annually

Processes or controls personal data of 25,000 or more Colorado residents AND receive revenue from or a discount on the price of goods and services from the sale of personal data

Establish a clear and accessible privacy policy

Minimize data collected and avoid secondary use of collected data

Obtain clear, freely given consumer consent for data collection and use

Consent must also be clear and affirmative for collecting categories of sensitive personal information

Establish and maintain reasonable data security protocol

Ensure contracts with vendors are compliant with CPA

Conduct regular risk assessments

The right to know whether a controller is processing their personal information

The right to access, correct, delete, and/or obtain a copy of their personal information

The right to opt-out of the processing of their personal information

Conduct business in Connecticut and

Control or process personal data during the preceding year of at least either:

100,000 consumers, excluding personal data controlled or processed solely for completing a payment transaction, or

25,000 consumers who derived more than 25% of their gross revenue from selling personal data.

Limit collection to adequate, relevant, and reasonably necessary information

Clearly explain in a privacy notice what information is being collected and why

Disclose both internally and externally access to any information collected

Limit use of collected information to disclosed purposes

Clearly detail how consumers can enforce their rights

Provide reasonable “administrative, technical, and physical” data security measures

Establish compliant contracts with all vendors

Complete data protection assessments for all activities that risk data exposure

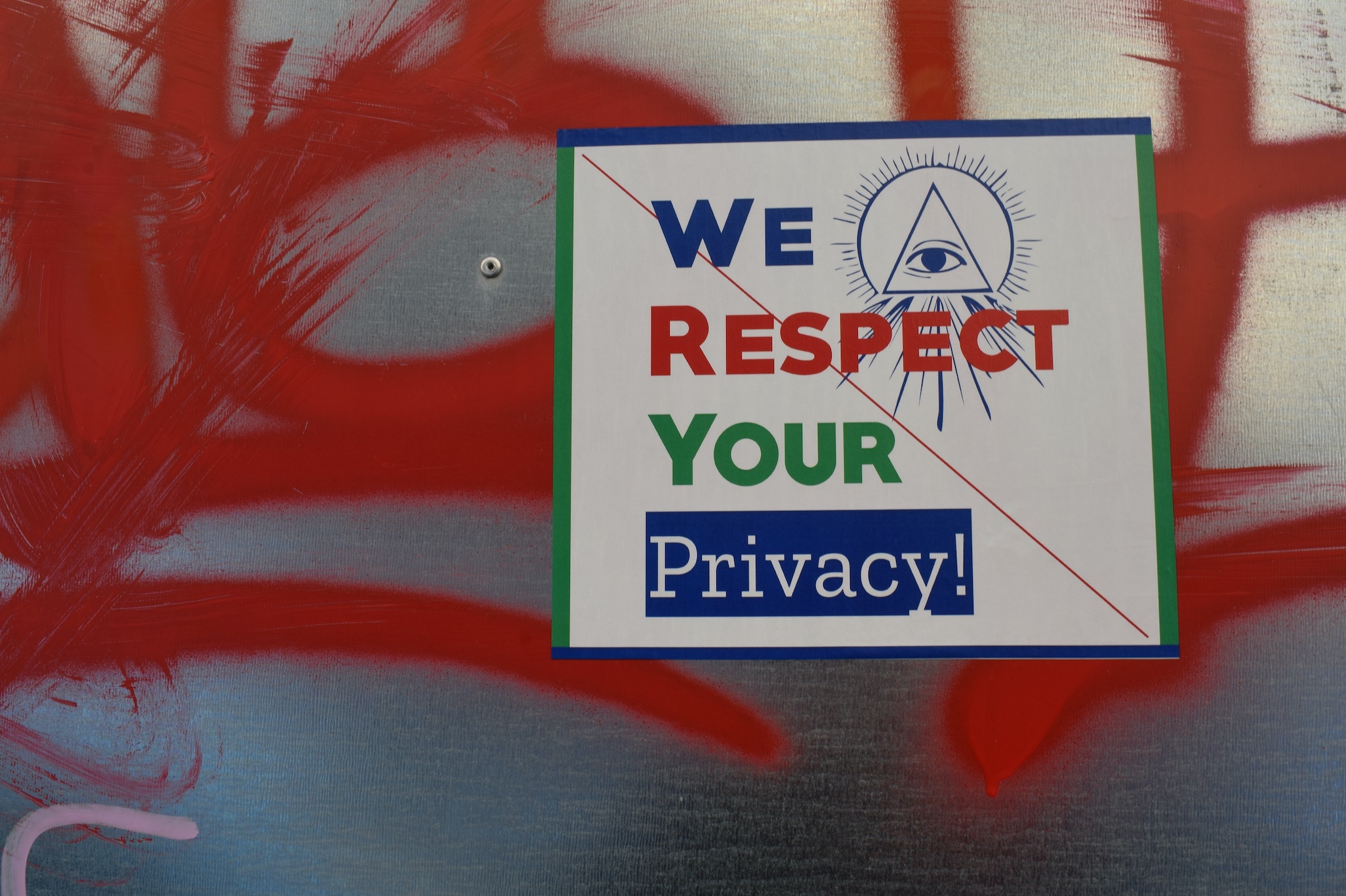

Sign saying We Respect Your Privacy; image by Marija Zaric, via Unsplash.com.

Sign saying We Respect Your Privacy; image by Marija Zaric, via Unsplash.com.

The right to access, delete, and/or obtain a copy of their personal information processed by a controller

The right to opt-out of the sale of their personal data, or the usage of personal data for targeted advertising

Controls or processes the personal data of 100K or more consumers annually

Derives over 50% of gross revenue from the sale of personal data and controls or processes the data of more than 25K consumers

The right to know, access, and confirm personal information

The right to correct and delete personal information

The right to opt-out of the processing and sale of personal information for targeted advertising and profiling purposes

The right to non-discrimination when exercising said rights

Process sensitive data of at least 100,000 Virginia residents annual OR

Process the sensitive data of at least 25,000 consumers AND derive at least 50% of gross revenue from said sale

CAN-SPAM: Also known as the Controlling the Assault of Non-Solicited Pornography And Marketing Act of 2003, which guards against unwanted marketing emails

TCPA: Telephone Consumer Protection Act of 1991, which guards against unwanted telephone marketing calls and some telemarketing practices

HIPAA: No, the “P” in HIPAA does not stand for “privacy,” as many people mistakenly assume. In fact, the Health Insurance Portability and Accountability Act is less about data privacy and more about communication between individuals and covered entities—health care providers, pharmacies, and insurance companies, for example. It has become the de facto standard for health care privacy.

FCRA: Fair Credit Reporting Act applies to information found in your credit report—who can see it, what information can be collected by credit bureaus, and how it can be collected.

FERPA: Family Educational Rights and Privacy Act keeps educational institutions from disclosing identifiable information without consent, ultimately giving parents and students more control over their educational records.

GLBA: Gramm-Leach-Bliley Act doesn’t exactly keep financial institutions from collecting and sharing data—but it does require them to disclose that information to consumers, and to ensure the security and confidentiality of consumer records and data.

ECPA: Electronic Communications Privacy Act restricts government agencies from wiretapping phone calls and other electronic signals. Because this law was passed in 1986, well before the internet age, many consider it outdated, as it doesn’t apply to data stored online.

COPPA: Children’s Online Privacy Protection Rule restricts data collection for children under 13 years of age.

California has also passed a new privacy law for children, which will become effective in July 2024

FTC Act: Federal Trade Commission Act was created to monitor and prevent deceptive or unfair business practices by anyone involved in commerce, including banks.

Run a data inventory. Sometimes referred to as a “data map” or “data mapping,” a data inventory is a comprehensive record of all the data your company holds, including who has access to it and how it is being used.

Update your privacy notice. Spell out exactly what, when, and how your customers’ data is being used—and make sure it’s easily accessible and readable.

Assess your vendors for privacy compliance. Whether it’s for email marketing, credit card processing, IT, or otherwise, you need to pay attention to what any third-party vendors are doing with your customers’ information—because as their contracting company, you will be held fully liable for any customer data that is compromised.

Set up a privacy preference center, which allows website visitors to choose whether to opt in or out of your cookie policy.

Train your staff on privacy best practices. Offer ongoing professional development opportunities so that the people handling your customers’ data stay up-to-date on ever-evolving privacy laws.

Work with a privacy consultant. Consider working with an experienced privacy consultant so that you don’t have to wonder whether you’re maintaining compliance with privacy laws—or how to do it.

About Jodi Daniels

Jodi Daniels is a Certified Informational Privacy Professional (CIPP/US) with more than 20 years of experience helping a range of businesses from solopreneurs to multi-national companies in privacy, marketing, strategy, and finance roles. During her corporate career, she proved a valuable asset to companies like Deloitte, The Home Depot, Cox Enterprises, and Bank of America where she most recently served as the privacy partner for Digital Banking and Digital Marketing. Ms. Daniels started her privacy career by creating the comprehensive privacy program at Cox Automotive. She launched an online advertising network for Autotrader and Kelley Blue Book.