How Do I Fight a Denied Insurance Claim?

How Do I Fight a Denied Insurance Claim?

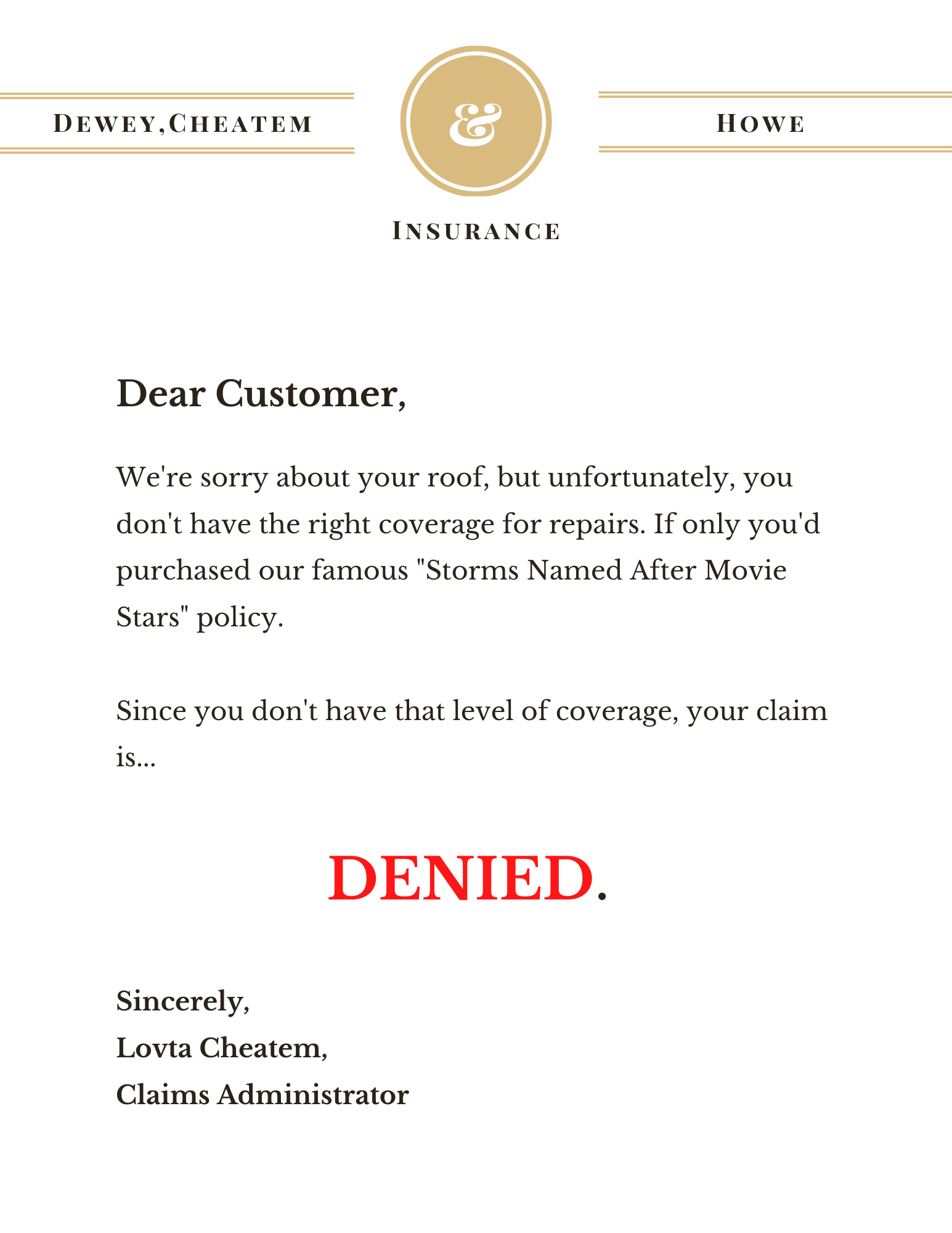

You’ve just suffered a tremendous amount of damage to your home. Fortunately, you have home insurance, so you can simply file a claim with your provider and recover a settlement. Well… that’s what you thought was going to happen, but now you’ve just received a letter stating that your claim has been denied. Does this story sound familiar? Unfortunately, these experiences are all too common. So how exactly do you fight a denied insurance claim?Your first step should be to get in touch with a qualified attorney who has experience with denied insurance claims in Florida. These legal professionals can help you file an appeal, allowing you to push back against the denied claim and recover the compensation you need and deserve. Book a consultation with one of these attorneys, and you can explore your full range of options when dealing with a denied claim. Read the Denial Letter CarefullyYour first step is simple: read the denial letter carefully. In this letter, your insurance provider should make it clear why they are denying your claim. Although the legal language can be difficult to decipher at times, you should strive to understand what they’re saying before you take your next steps. You can’t fight your denied claim effectively until you understand exactly why your claim has been denied.

Claim denial letter; image by Jay W. Belle Isle.

Claim denial letter; image by Jay W. Belle Isle.

About Peter Charles

Having graduated from Saint John’s University in 1993, Peter Charles, Chief Operating Officer, brings a dynamic 28-year sales career reflecting pioneering experience and record-breaking performance in the computer and internet industries. He remains on the industry’s cutting-edge, driving new business through key accounts and establishing strategic partnerships and dealer relationships to increase channel revenue. He is currently focused on providing multiple revenue streams for USAttorneys.com. He can be reached at 800-672-3103.