Is Not Paying Overtime Illegal?

Is Not Paying Overtime Illegal?

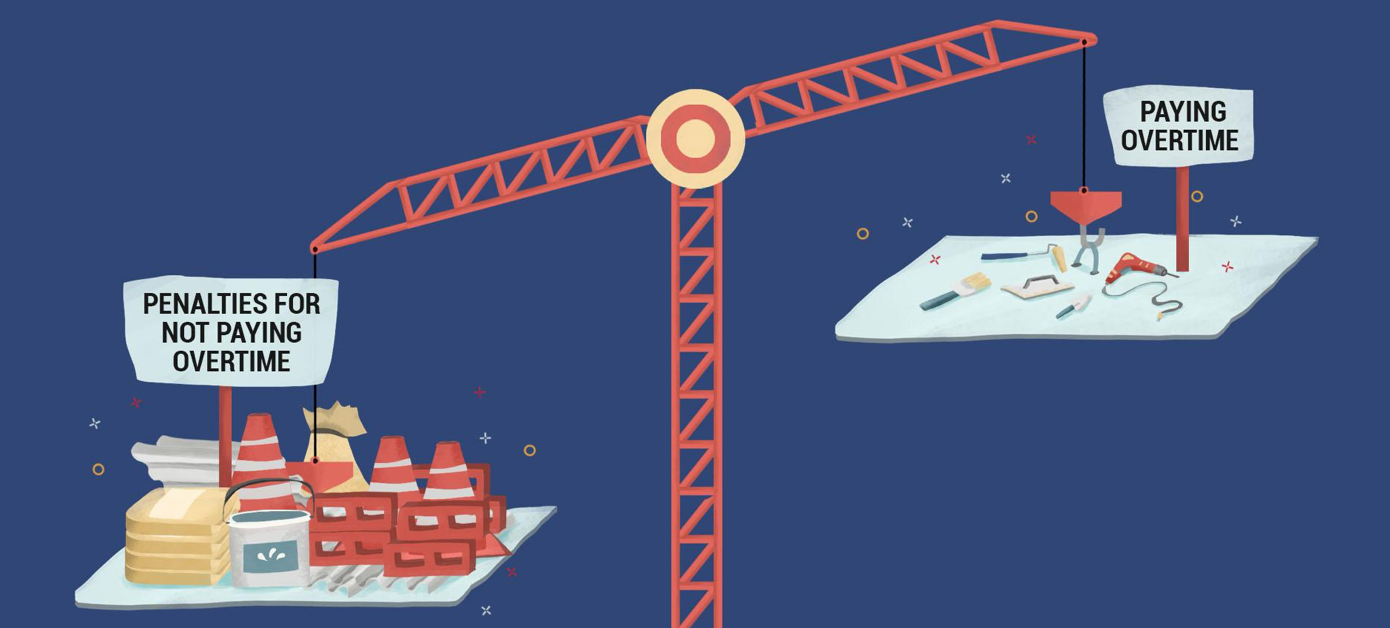

First things first—what does federal law say about paying your employees overtime?All hourly, or non-exempt, employees must receive overtime pay for any hours they work over 40 in a workweek—at a rate of 1.5x their regular pay.Under the Fair Labor Standards Act (FLSA), there is no limit to the number of hours an employee can work in any workweek, and you aren't required to pay overtime for work on Saturdays, Sundays, holidays or regular days of rest, unless overtime is worked on those days.Even if your non-exempt employees work overtime without your approval, under federal law, you must still pay them overtime rates for those hours worked. Not compensating them in this scenario would be illegal.When are you exempt from paying employees for overtime hours?So, current labor laws dictate that not paying overtime is illegal—but only in certain circumstances. There are a variety of situations where you’re exempt from the above overtime requirements and are not actually obligated to pay your employees overtime wages.But the question is—what, exactly, are those overtime exemptions?If you have employees that are a) paid on a salary basis, and b) make a salary of at least $684 per week, those employees are exempt from overtime (sometimes called a “white collar” exemption). While most salaried employees are exempt, it’s important to note that if you have a salaried employee who makes less than $684 per week—which works out to less than $35,568 per year—they are entitled to overtime payments.Another case where employers are exempt from paying an overtime rate is in working with independent contractors. Because independent contractors are not employees (and generally have more control over their schedule and work hours), the overtime rules don’t apply to them. And, as an employer, you’re not required to pay an overtime rate to independent contractors—regardless of how many hours they work in a workweek.What happens if you don’t comply and pay required overtime?So, as mentioned, if you have non-exempt employees that work for your company—and those employees end up working overtime hours—you’re legally required to pay them overtime wages (which is at least one-half times the employee’s regular rate of pay) for the number of overtime hours worked. And it’s extremely important that you provide that overtime pay—because otherwise, you’re looking at some serious penalties.If you fail to comply with the Federal Fair Labor Standards Act and don’t pay your eligible employees for overtime hours worked, not only will you be liable to pay for those unpaid overtime hours, but you could find yourself facing hefty fines from the state and/or the Department of Labor, including liquidated damages (which provides pay to your employees) and civil penalties. You may also have to foot the bill for the costs your employee incurred while seeking legal advice and counsel—and if you continually fail to pay overtime, you could face criminal charges.The point is, the penalties for not paying overtime pay are far greater than just paying for the overtime from the get-go—so make sure you’re compensating your employees for any overtime hours during the pay period those hours were worked.What are some scenarios where you would be required to pay for overtime—and what are some scenarios where overtime pay would not be required?Clearly, there are cases where employment law requires you to pay overtime. But there are also cases where you’re not required to pay overtime—regardless of how many hours your employee works.So, what do those two different scenarios look like in action?Let’s say you have an employee that gets paid an hourly rate of $20 per hour. Typically, the employee works 40 hours per week, but during one workweek, they end up working 12 additional hours—for a total of 52 hours. Because the employee is paid by the hour and is considered non-exempt, you would be required to pay overtime for those 12 additional hours at a rate of one and a half times their regular rate—or $30 per hour.So, in that scenario, the employee would get paid their regular weekly wages ($20 x 40 = $800) plus 12 hours of overtime ($30 x 12 = $360) for a total of $1160.

Photo by Adam Nowakowski on Unsplash

Photo by Adam Nowakowski on Unsplash

About Deanna deBara

Deanna writes for Hourly, a Silicon Valley technology company with a single mission - help hourly employers and employees achieve their goals better and faster. To make that happen, they have built the world’s best platform to manage, pay, and insure the hourly workforce. They bring enterprise level technology solutions to small and medium size businesses.